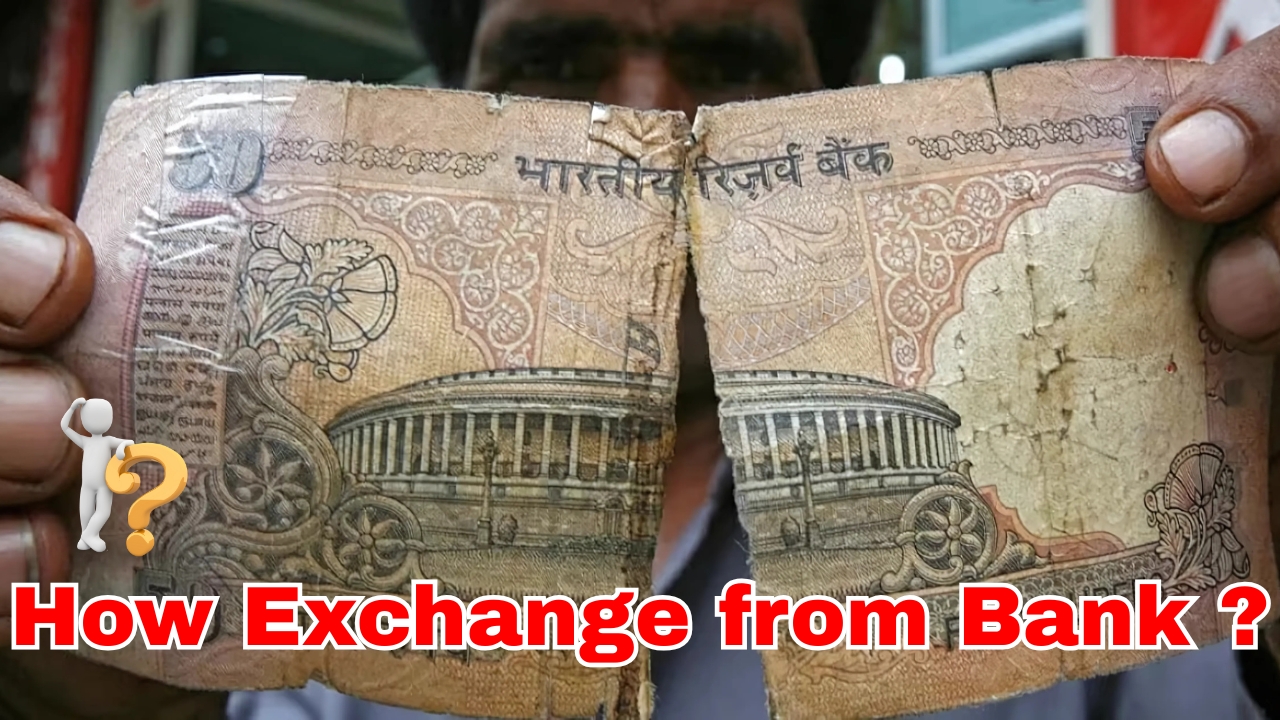

Exchange destroy notes : Every day, millions of Indian currency notes are taken out of circulation — torn, soiled, damaged or simply too worn to be used.

But what happens to those notes when they near the end of their lifecycle? Currency that is too old to remain in circulation is shredded in an environmentally friendly, secure, and high-tech process, according to the Reserve Bank of India (RBI).

Such a controlled mechanism allows conservation of currency notes and coins without compromising their monetary value and building people’s trust in the Indian currency system.

Exchange destroy notes A Banknote’s Life: Printed, Circulated and Finally Destroyed

The life cycle of an Indian banknote starts with specialized currency printing presses at Mysuru, Salboni, Nashik and Dewas, but at some point in time, every note needs to be withdrawn from circulation and destroyed.

The average life of an Indian banknote can be significantly different based on the denomination – smaller value notes such as Rs. 10 have a lifespan in circulation of about 1-2 years whereas Rs. 500 and Rs. 2,000 notes have a lifespan of 3-5 years and hence, replace these after five-six years of circulation.

“Currency notes are manufactured products with a limited life and shelf-life,” says Ramesh Kumar, a retired official of the RBI who has worked in currency management.

“Through physical handling, exposure to the environment and circulation patterns, the security features and physical integrity of notes degrade gradually, until they are no longer fit for automated processing or for hand counting.”

Banks are the first line of defense in identifying notes eligible for retirement. Frontline staff and cash processing machines divide notes into three groups: clean notes suitable for recirculation, soiled notes that need to be destroyed and suspected counterfeit notes, which require specialist handling.

This first sort takes place at the branch level, before notes are sent upstream in the banking system.

Exchange destroy notes Mechanism of Classification and Collection

The RBI has devised a clear classification of currency notes that decides their destiny:

Notes that have been soiled exhibit typical wear and tear, yet remain mostly whole.

These are the vast majority of notes withdrawn from circulation — normally faded, the edges a little tattered or with some writing marks, but not so much that security features are obscured.

Banks take these notes from customers and subsequently hand them over to the RBI for destruction.

Mutilated notes are significantly damaged with large tears, missing portions or extreme decomposition which however retain characteristics so they can be identified as being true to the banknote.

Such notes require special processing at select branches of banks or Reserve Bank of India (RBI) offices where trained personnel can verify and assess the value of these damaged notes.

Defective series of notes have printing process defects. While rare, such notes are pulled from circulation as soon as they are identified and returned directly to the issuing authority.

Fake notes, on the other hand, are treated under a wholly different procedure, that involves notifying the police, forensic documentation, and destruction of the notes under security protocol.

The most granular level of collection is for bank branches to collect unfit currency from daily transactions.

The branches periodically redeposit the accumulated uncircular notes in their regional currency chests, special storage facilities that banks run for the RBI as per its guidelines.

All these currencies move to the RBI’s Issue Offices that have special destruction facilities from these chests.

“The multi-tiered collection system ensures efficient aggregation while enforcing security across the process,” says financial analyst Meena Sharma.

“Currency: individual transactions to individually secure consolidations to fewer total/consolidations.”

Exchange destroy notes Currency Verification and Processing System

Central to the RBI’s currency management setup is the Currency Verification and Processing System (CVPS) — complex machines that detect the genuineness and state of banknotes with astonishing accuracy.

These high-speed systems can process 2,000 notes a minute and perform several verification checks at the same time.

The CVPS utilizes independent technologies to authenticate notes, which include:

-

Infrared and ultraviolet sensors for detecting security features that are not visible to the naked eye

-

Optical sensors that identify holographic features used on real bank notes.

-

Metrics 0 – Dimensional verification that measures exact note specifications

-

Serial number and other printed element optical character recognition

In addition to authenticating, the systems categorize notes based on their physical condition, using sensors that detect tears, holes, tape repairs, graffiti, soiling and limpness.

This automated assessment decides if notes are released back into circulation or sent to the shredder.

“The technology offers an objective, constant assessment of the state of the note,” Vikram Singh, a banking technology expert, says.

“Human sorters could have made differing judgments simply because they were tired or interpreted the same guidelines in different ways, whereas the machines apply the same precise criteria to every note.”

Nothing meeting the condition thresholds bypasses directly to destruction while maintaining a secure chain of custody.

Every processed note is tracked in detail, with detailed audit trails of each note as necessary for financial responsibility.

Exchange destroy notes Methods of Destruction: From Shredding to Briquetting

The RBI uses different destruction method based on facility capabilities and volume needs.

Notes are primarily destroyed through the use of industrial shredders, which reduce notes to very small pieces (usually around 5- to 6mm) – small enough that they cannot be reconstructed, although the make up can be verified if the notes are required for audit purposes.

“These are special paper shredders,” explains Deepak Verma, an engineer who has worked with currency processing machinery.

“They are very specialized machines built specifically for destroying currency, with a series of cutting discs that produce a cross-cutting pattern, which is much more secure than traditional shredding.”

The shredded currency chips then receive one of several post-processing treatments:

Briquetting is when high-pressure compacted shredded currency turns into dense blocks.

But unlike loose shredded material, these briquettes take a fraction of the space, making them easier to store and distribute — while making it even more difficult to recover the destroyed material in the event of any theoretical reconstruction attempt.

Pulping is the process by which the cotton-fiber-based currency stock is returned to a paper pulp form via chemical and mechanical means.

This process destroys all printing and anti-counterfeit features and leaves only raw fiber materials.

Incineration in regulated, high-temperature furnaces reduces notes to ash under controlled environmental conditions.

However, this practice was common in the past, before Green alternatives became popular and widespread, and was basically only used in some specific cases.

Every method of destruction is conducted under dual-control procedures which stipulate only authorized staff may attend the process, and that this must cover the entire process from start to finish.

Every step is captured on camera, and meticulous documentation tracks each batch of notes from the moment they arrive through their ultimate destruction.

Exchange destroy notes Relationship between currency destruction and the environment

Modern currency destruction: The balance between security mandates and environmental responsibility In the last couple of years the RBI has undertaken a number of environment friendly initiatives which are turning disposed off currency from a waste to a resource:

Recycling into paper products turns shredded notes into paper products like cardboard packing, specialty papers, and even products used in construction applications, like ceiling tiles.

Such recycling usually happens via contracts with licensed private manufacturers following secure protocols.

At the Composter climate, composting currency is being introduced as an innovative alternative for smaller volume processing.

And because Indian currency paper is made predominantly from cotton fiber instead of wood pulp, it decomposes relatively well in industrial composting plants, producing nutrient-dense soil amendments.

In industrial boilers designed for waste-to-energy conversion, currency briquettes are used as fuel, resulting in the generation of heat energy with complete destruction of currency materials.

In this context, the high cotton content of Indian banknotes provides good fuel value with relatively clean burning characteristics.

“The move to circular economy principles in currency destruction is a significant advancement,” writes environmental policy researcher Nandini Gupta.

“Turning retired currency into useful products or energy is not only in keeping with wider sustainability goals but can also be done alongside rigorous security controls in place.

In the latest year (2019) for which data is available, almost 70% of dismantled currency material reported by the RBI is directed for some sort of recycling or energy recovery instead of being disposed of and the central bank has set targets to further increase this percentage in subsequent years.

Exchange destroy notes Audit Mechanisms and Security Protocols

Term dealing with physical currency, destruction processes include multilayer security procedures more than typical banking regulations. These include:

Physical integrity—destruction facilities have toxic areas, monitoring equipment, biometric locks for authorized users, protective architecture designed to hinder the removal of material without permission.

“Controls to ensure that, for each batch of destruction, multiple authorizations were required to be in place, notes could not be counted by a party to their destruction prior to witnessing the process and waiting for a mandatory period to reduce potential errors of fatigue.

Reconciliation requirements identifying each note received for destruction with specific denomination, quantity, condition classification and destruction method documented. Discrepancies trigger immediate investigation protocols.

Unannounced inspection by independent RBI departments or third party auditors who can show to ensure compliance with destruction process.

Such audits are done by physical inspection, from reviewing documents, to witness of the actual destruction processes.

Security measures are continuously updated in accordance with emerging technologies and lessons learned with respect to new vulnerabilities identified through the RBI’s risk assessment processes.

Exchange destroy notes End Notes: Secure Destruction To Preserve Currency Integrity

The disposal of unfit currency is a vital and neglected segment of India’s monetary infrastructure.

By using systematic methods for the collection, verification, destruction, and documentation of the currency, the RBI guarantees that currency is retired from circulation with the same integrity as when it was initially issued.

For the everyday citizen, this invisible infrastructure helps keep confidence in physical currency while ensuring that those handling notes in circulation meets usability standards and preventing counterfeiting.

Few people should see a valid currency being destroyed, but securely, soundly destroying currency actually protects the entire monetary system on which all economic activity depends every day.”

As physical currency evolves side by side with digital payment technologies, so too will the processes surrounding the destruction of currency evolve to meet our core needs of security and accountability, even more so as the focus on environmental sustainability and resource efficiency becomes increasingly important across all areas of currency management.

Also Read This-

-

9 Rare Dimes are still in market and worth it $600 Million

-

Hero Optima EV segment scooter launch with low cost

-

New Rajdoot Bike coming soon with modern features